An Owner's Title Insurance Policy Covers Which of the Following

A standard title insurance policy ordinarily. Title insurance policies also cover the cost of resolving also known as curing most title problems also known as defects uncovered during the title search.

What Is Title Insurance Pioneer Title Co Going Beyond

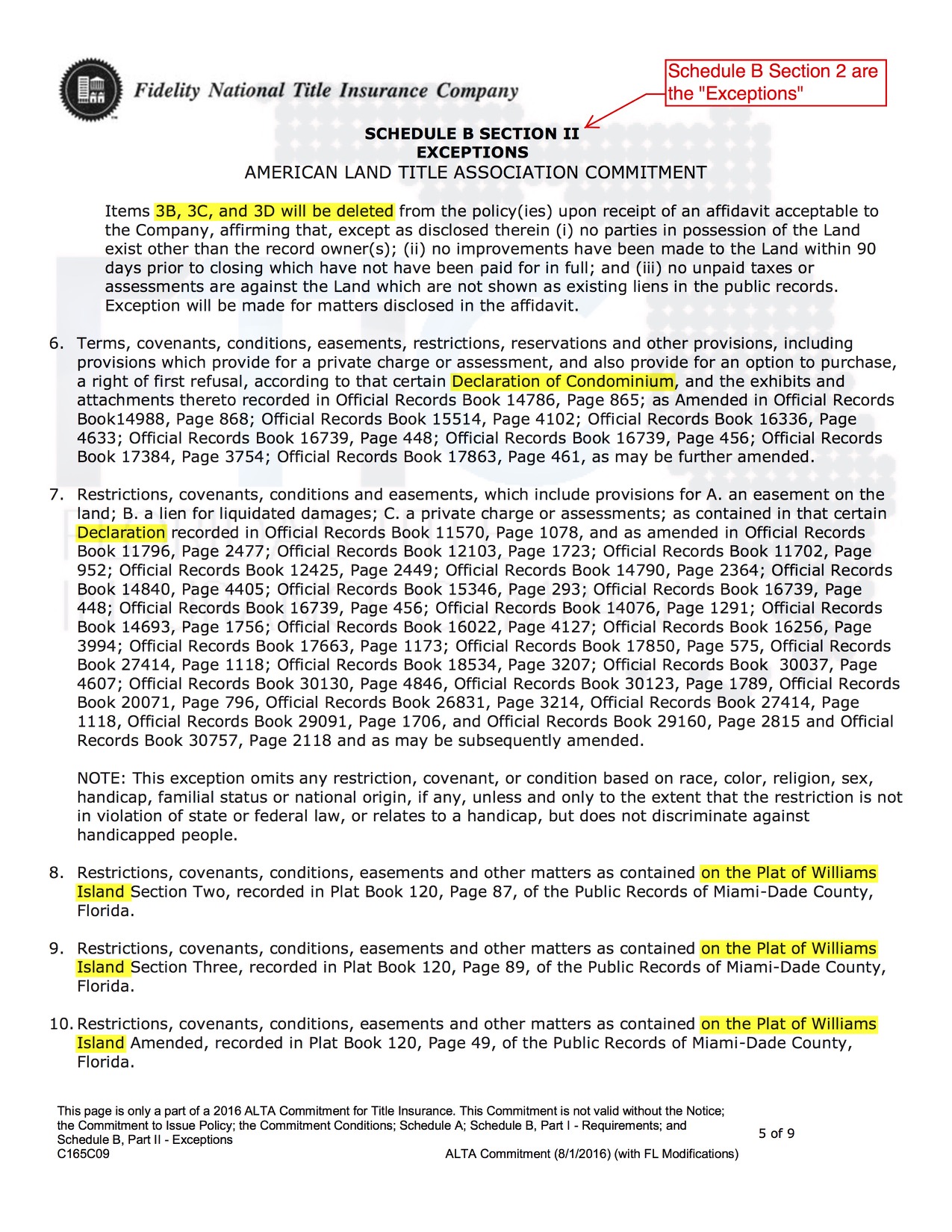

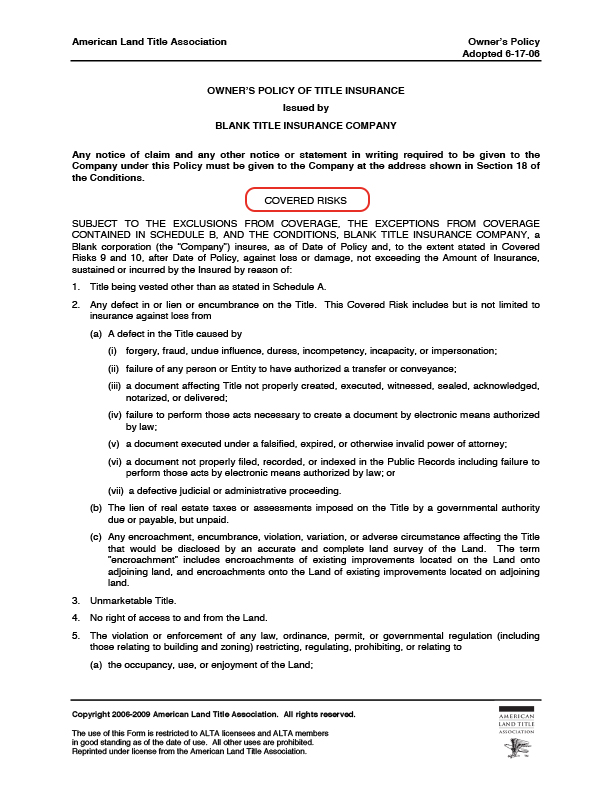

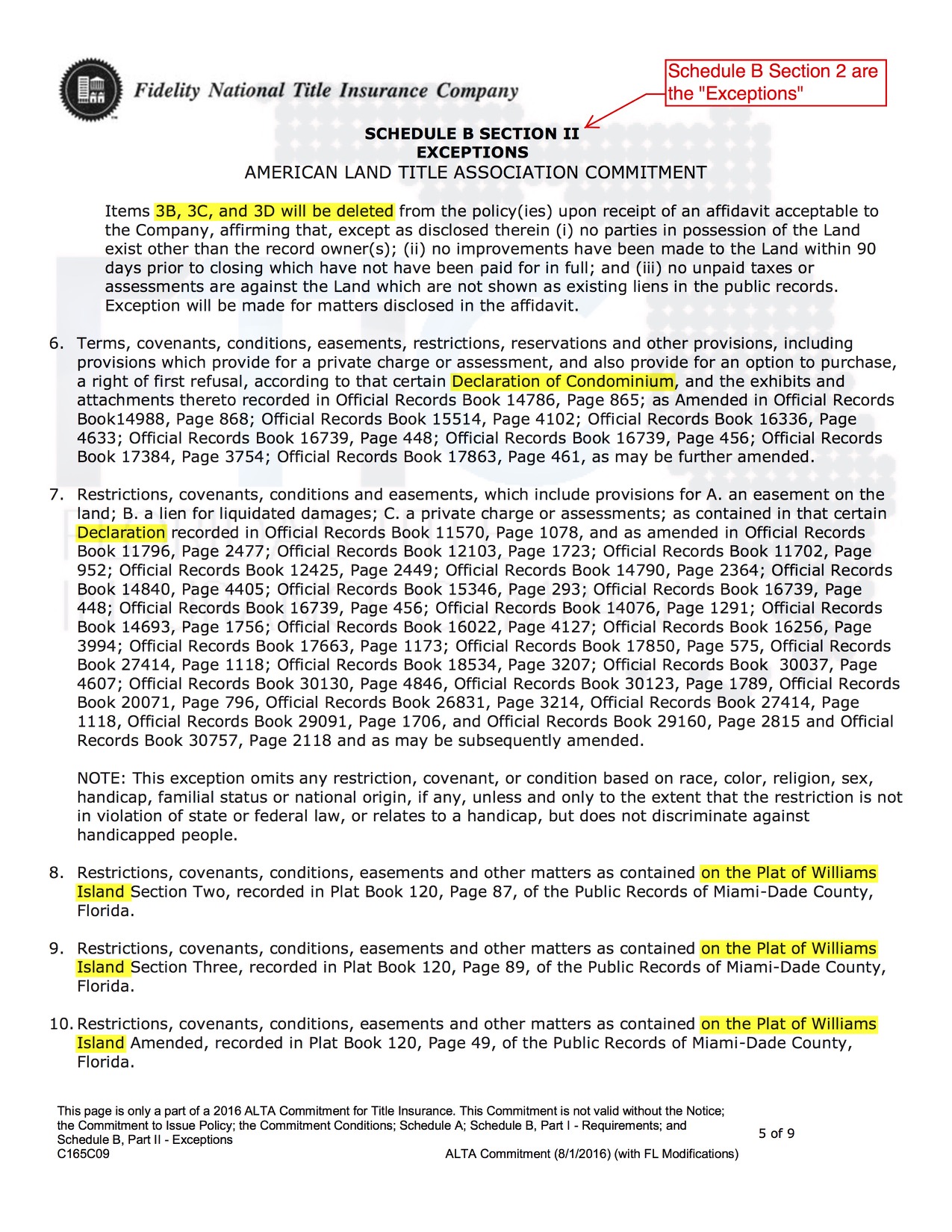

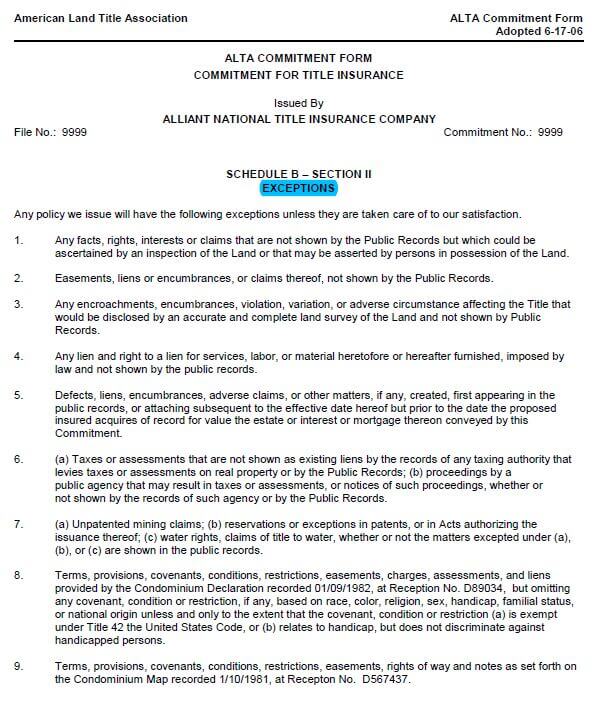

The standard exceptions to coverage found in owner title insurance policies include the following.

. An Owners Title Insurance Policy with protection equal to the purchase price protects the buyer against title defects see list below created by previous. Rights of parties in possession D. B - lack of signature of either husband andor wife.

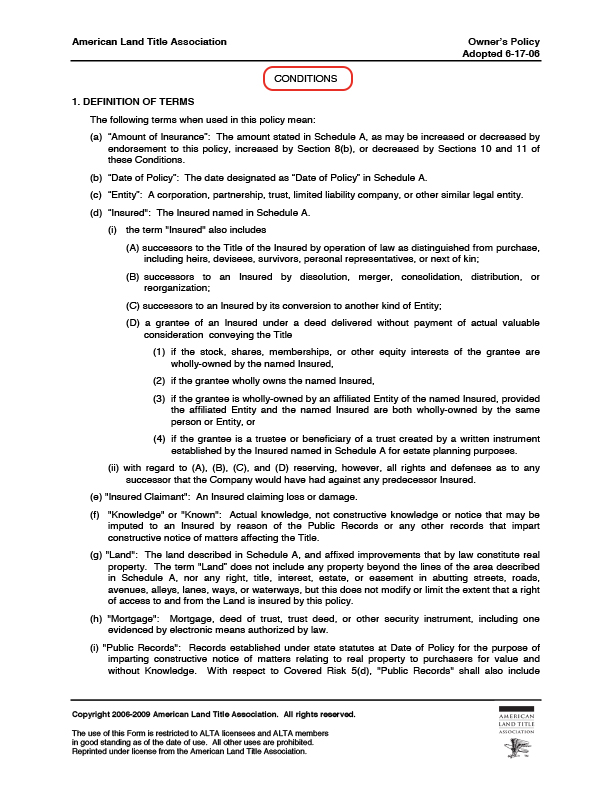

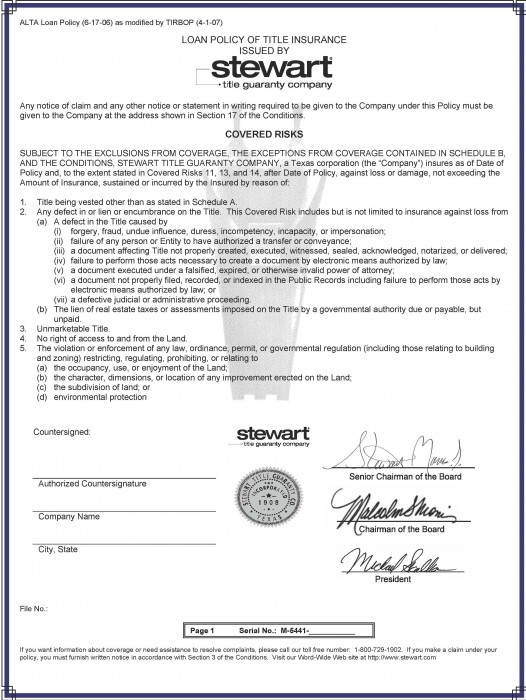

The loan policy is issued to the mortgage lender. An Owners Title Policy is designed to protect you from covered title defects that existed prior to the issue date of your policy. This is not like your home or auto insurance coverage.

A Standard Policy of Title Insurance covers all of the following EXCEPT. With those policies you buy protection for events that may happen in the future. Title insurance is an insurance policy that protects you the home owner against challenges to the ownership of your home or from problems related to the title to your home.

Protects only the party named as the insured party in the written policy. The Owners Policy has its origins in a form of policy adopted by the American Land Title Association in 1970 and revised in 1984 and 1992. In most cases owners title insurance is not required in a home purchase but it is recommended.

An owners policy of title insurance is essential to cover your investment from potential future claims. You are forced to remove your existing structure s because it they encroaches onto your neighbors land. The average cost of title insurance is around 1000 per policy but that amount varies widely from state to state and depends on the price of your home.

Owners title insurance covers you against title claims due to PAST and FUTURE title defects that surface. A standard title insurance policy will protect the insured against all of the following except. It can be paid for by the seller at closing so you may want to negotiate for it when you are purchasing a home.

Loss of title to a claimant with superior right of title A written summary of the history of all conveyances and legal proceedings affecting a specific parcel of real estate is called an. That there is some defect or encumbrance on your title caused by fraud or forgery. Common defects include but are not.

A Lenders Title Insurance Policy protects the lender against financial loss if there is ever a dispute that would challenge their lien position with protection equal to the loan amount. You are covered as long as you have an ownership interest in the home You never have to buy it again. The risk that someone else owns your property.

It protects you from someone challenging your ownership of a property because of an event involving a previous owner. A title plant is a. C - zoning laws.

Extended coverage in an owners title insurance policy would cover which of the following. A - forgery and matters of record. Incorrect marital statements C.

Whichever is less Title Companys Maximum Liability is 2500000. The owners policy protects against losses from ownership problems that arose before you bought the property but werent known at the time of purchase. A customer deductible amount of either 1 of Policy Amount or 250000.

Title Companys Maximum Liability is 2500000. An owners title insurance policy protects the owner against. Standard coverage in an owners title insurance policy would cover all of the following EXCEPT A incompetent grantors B defects found in public records C forged documents D changes in land use brought about by zoning ordinances.

In this article we are going to talk about the things that your owners title insurance policy does not cover. One is the owners policy and the other is the loan policy. In the most current ALTA Owners policy there are ten covered risks listed in the policy.

Unrecorded liens not known by the policyholder A deed contains a promise that the title conveyed is good and that the grantor will obtain and deliver any documents necessary to ensure good title. This covered risk is subject to. A basic owners title insurance policy typically covers the following hazards.

There are two types of policies issued. The present version of the policy was adopted on June 17 2006 by the American Land Title Association after extensive revisions suggested by real estate professionals in the industry and its partners. Lender Policy vs Owners Policy.

Whats Owners Title Insurance. Title insurance premiums can vary from a. The policy provides coverage against losses due to title defects even if the defects existed before you purchased your home.

Owners title insurance is a policy on the deed of your home. Governmental Regulations Zoning water rights mineral rights etc. However title insurance does not cover everything.

Title insurance can protect you. Any liens for real estate taxes or assessments that are due but unpaid. Ownership by another party Incorrect signatures on documents as well as forgery and fraud.

That are promulgated by federal state and local jurisdictions. A title defect is a problem with the title. When you purchase your home you receive a document most often called a deed which shows the seller transferred their legal ownership or title to their home to you.

If a valid claim is filed your Owners Policy subject to its terms and conditions will cover financial loss up to. The owners title policy is designed to protect the homeowner in case of any claims against their ownership of the home. Owners title insurance provides protection to the homeowner if someone sues and says they have a claim against the home from before the homeowner purchased it.

You are covered up to 150 of the purchase price so as your homes value increases it is covered. A title insurance policy with standard coverage generally covers all of the following EXCEPT A. Some of the most important covered risks are.

What Title Insurance Covers. Collection of real estate records.

Protect Your Property Rights Home Closing 101

Protect Your Property Rights Home Closing 101

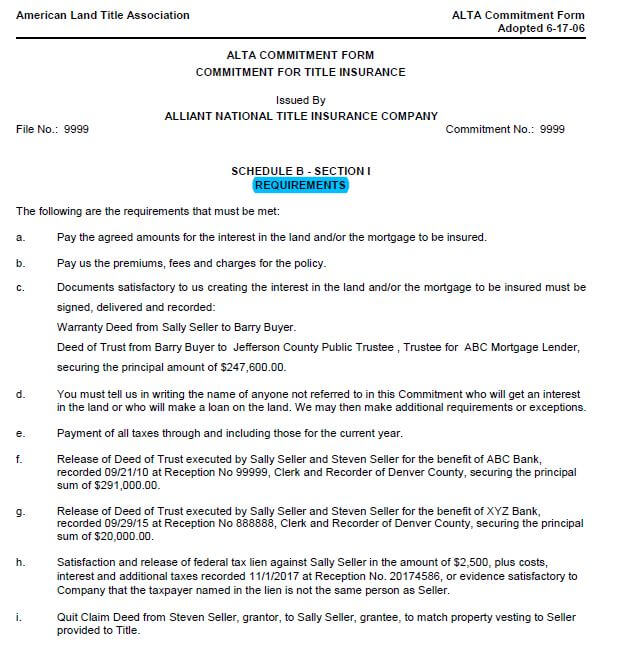

How To Read A Title Commitment Florida S Title Insurance Company

The Importance Of An Owner S Title Insurance Policy Title Insurance Insurance Marketing Insurance Policy

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

What Is Title Insurance Pioneer Title Co Going Beyond

February 2015 Hawaiian Kingdom Blog

The Smart Trick Of Title Insurance And Why You Need It That Nobody Is Discussing Boat Booker

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

0 Response to "An Owner's Title Insurance Policy Covers Which of the Following"

Post a Comment